Tampa Chapter 7 Bankruptcy Lawyer

Chapter 7 Bankruptcy Lawyer Tampa, FL

A call to our trusted Chapter 7 bankruptcy lawyer Tampa, FL turns to should be one of your first steps. Especially if you struggle to answer your phone each time a number comes through that you do not recognize. As debts begin to increase, many may be unable to make their regularly scheduled payments, and as a result, debtors may succumb to incessant calls from collections agencies. While there are several types of bankruptcy filings to choose from, depending on your needs, we may recommend that you consider Chapter 7, one of the most widely used types of personal bankruptcy. Carolyn Secor, P.A., has seen many people come through her doors feeling shameful of their financial decisions. Know that you are not alone. Sometimes debts come as a result of the unexpected, and filing for Chapter 7 is a way to wipe the slate clean. The following outlines the process of filing for Chapter 7 bankruptcy:

Tampa Chapter 7 Bankruptcy Lawyer

- Chapter 7 Bankruptcy Lawyer Tampa, FL

- Know The Steps For Filing Chapter 7 Bankruptcy

- Chapter 7 Bankruptcy And Asset Retention: What You Need To Know

- Chapter 7 Bankruptcy Summarized

- Wage Exemption

- Personal Property Exemption

- Homestead Exemption

- What are common reasons Chapter 7 bankruptcy may be denied?

- Tampa Chapter 7 Bankruptcy Law Infographic

- Is Chapter 7 Right For You? Here Are Some Ways To Know

- Liquidation

- Eligibility

- Secured Vs. Unsecured Debts

- Tampa Chapter 7 Bankruptcy Law Statistics

- Frequently Asked Questions for Chapter 7 Bankruptcy

- What Does Pro Se Mean? Is It More Advantageous To Represent Me Rather Than Contacting A Lawyer?

- Can You Keep Your Car?

- What Is Needed When Filing For Bankruptcy?

- What Is The Automatic Stay? Why Is It Necessary?

- What Is The Approximate Cost To File For Bankruptcy?

- Are Your Tax Returns Garnished In Bankruptcy?

- Are 529 Plans Safe?

- Does Chapter 7 Help If You Lost Money In Multilevel Marketing?

- Carolyn Secor, P.A. Bankruptcy Attorney

- Tampa Chapter 7 Bankruptcy Lawyer Google Reviews

- Call for the Legal Help You Deserve

Know The Steps For Filing Chapter 7 Bankruptcy

Our team will work closely with you to gain intimate knowledge of your financial situation. We want to know the details of your financial dealings to make a decision that is informed by the specifics of your case. Once we understand your situation’s full scope, we can then provide you with options in your best interest. Sometimes, bankruptcy may not be the right step for you, and we will be able to offer you alternatives with our assistance. Know that after reviewing your case, it may be possible to discharge many of your unsecured debts under Chapter 7, for example:

- Credit Card Debt

- Medical Expenses

- Student Loans

- Utility Bills

- Personal Loans

Our Tampa Chapter 7 bankruptcy lawyer wants you to know that these types of debts are often just suitable for Chapter 7. However, if you have many secured debts such as car loans and house payments and want to retain the assets, another option may be more appropriate.

As part of the Chapter 7 bankruptcy process, debtors will need to qualify for this type of bankruptcy filing. We will need to know your income level when working with our team. This information is critical when determining whether your income falls below the state’s median standard. To decide whether or not you qualify for Chapter 7, debtors must undergo and pass the means test. If you cannot meet this standard, we can discuss alternative bankruptcy options that may be better suited to your needs. However, if you pass the means test, your next step will be to complete credit counseling. Credit counseling is a requirement for anyone considering bankruptcy as an option.

Once we have solidified that you qualify for Chapter 7 and that it is in your best interest to move forward, we will work closely with you to initiate the bankruptcy process. Chapter 7 filing begins with the bankruptcy petition. For this, you must produce all relevant information regarding your debts and assets so that we can move forward seamlessly. Know that any non-exempt property will need to be liquidated to pay off your debtors during the process. Despite this, it’s important not to fret; we will work closely with you to ensure that you can keep as many of your assets as possible. In some situations, we will help you retain many of your assets throughout the process.

To finalize the process, debtors must meet with the bankruptcy trustee and attend a creditors’ meeting, also known as the 341 meetings. Following this process, debts are discharged, and you will be able to move forward with a clean slate officially.

Chapter 7 Bankruptcy And Asset Retention: What You Need To Know

When faced with bankruptcy, people can often feel ashamed, like they failed. Nothing could be further from the truth. Any hardworking American may find themselves with insurmountable debt due to factors entirely out of their control, like layoffs. According to the Federal Reserve, 340 million people are in a combined $14.6 trillion of debt. Talking to a bankruptcy lawyer is the first step in getting out of this debt and rebuilding your life.

Chapter 7 Bankruptcy Summarized

To briefly summarize how chapter 7 bankruptcy works, it is the liquidation of assets that will then be sold to pay off the debt. However, this doesn’t mean that you will be left with nothing. 96% of those who file for bankruptcy retain all of their assets.

This is due to exemption laws, meaning that there are certain protected assets the court can’t order you to liquidate. These exemption laws vary depending on the state. They can be incredibly complicated, so it is best to speak with a chapter 7 bankruptcy lawyer in Tampa, to protect your property.

Wage Exemption

How much of your wage is exempt depends on how much you make. If you are the household’s main provider, your wages are exempt, either up to $750 a week, 75% or 30 times the federal minimum wage. Bankruptcy protection law will automatically defer to whichever is the greater amount.

If you are an additional contributor to the household finances, your wages are exempt, either 75% or 30 times the minimum wage.

If you are retired and on a pension, the law becomes increasingly complicated. Your retirement account may be exempt depending on what kind you have and how much money is in it. You may also be exempt if you are a police officer, firefighter, or teacher.

Personal Property Exemption

Personal property exemptions can apply to any property outside of real estate, such as electronics, jewelry, or art. Personal property can be protected for up to $4,000 if the homestead exemption is not used.

Under Florida law, certain savings accounts are protected. This includes education funds and hurricane funds.

Tax credit and refunds are also exempt from liquidation in Florida.

Homestead Exemption

If you have owned property in Florida for at least 1,215 days, it may be exempt. Depending on the size and location of your home, you may be entitled to unlimited exemption.

Don’t let the stigma of bankruptcy keep you from reaching out for help because you are not alone. There are 340 million Americans in the same boat. With proper legal representation, you can protect yourself and your property while getting back on your feet.

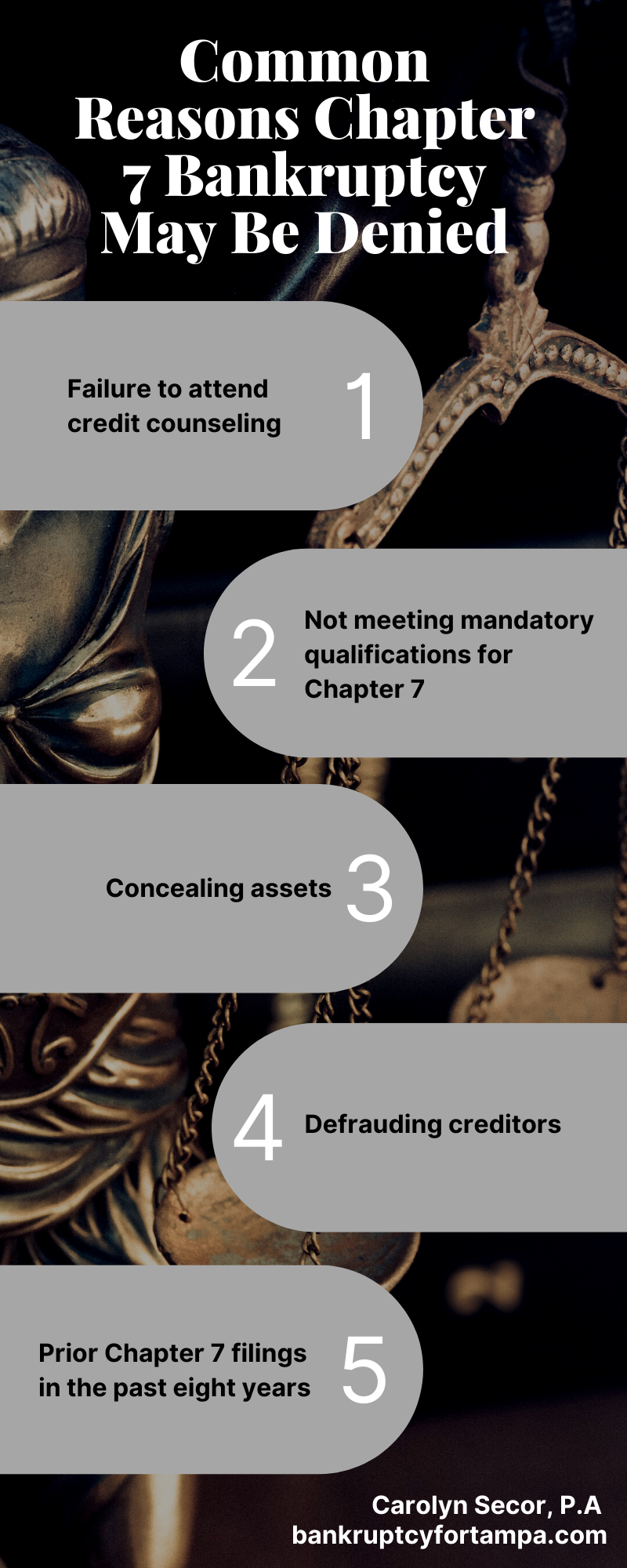

What are common reasons Chapter 7 bankruptcy may be denied?

There are several ways a bankruptcy discharge can be denied, so a lawyer will play a key role as they can help avoid any complications present that could impact the outcome. Common reasons for denials include:

- Failure to attend credit counseling

- Not meeting mandatory qualifications for Chapter 7

- Concealing assets

- Defrauding creditors

- Prior Chapter 7 filings in the past eight years

Tampa Chapter 7 Bankruptcy Law Infographic

Is Chapter 7 Right For You? Here Are Some Ways To Know

If you’re considering bankruptcy, you are ready to take control of your finances and get your life back. While this is an essential first step, you may not know much about what to expect during bankruptcy proceedings. You may be wondering if you should contact a Tampa chapter 7 bankruptcy lawyer, or consider other options. Carolyn Secor, PA, works as a bankruptcy attorney in Florida. She advises her clients that the kind of bankruptcy they choose will be determined by their eligibility and vision for the future. Of the three bankruptcy proceedings, Chapter 7 is among the most common. If you consider filing for Chapter 7, this is what you need to know.

Liquidation

Liquidation is the most important part of Chapter 7 bankruptcy. Should you file, you will work alongside a chapter 7 bankruptcy lawyer in Tampa, FL, to sell qualifying assets. The cash generated by these sales will then be used to satisfy your creditors.

The prospect of liquidation is often concerning to debtors turning to bankruptcy to seek relief. Carolyn Secor, PA, reassures her clients of two things. The first is that her clients will not lose everything. Bankruptcy law provides regulations on what is eligible for liquidation and what is not. Secondly, liquidation has the benefit of being a relatively quick process. This is because there is no long-term payment plan put in place. If you are looking to get out of debt quickly, Chapter 7 could prove advantageous to you.

Eligibility

A means test determines eligibility for Chapter 7. The primary means test for this metric is the median income in Florida. To qualify for Chapter 7 Bankruptcy, your household income must be below the state median income.

Secured Vs. Unsecured Debts

Chapter 7 is particularly effective at wiping out most forms of unsecured debt. Unsecured debts are debts that are not guaranteed by physical collateral. Mortgage or Car Loans are forms of secured debts, while unsecured debts include personal loans, medical debt, and credit cards. Remember that unsecured debt like alimony, child support, and student loans are not dischargeable under Chapter 7.

If any of this information is overwhelming or confusing, a qualified bankruptcy attorney will be able to answer your questions in detail and help you devise a strategy to get your finances back under control.

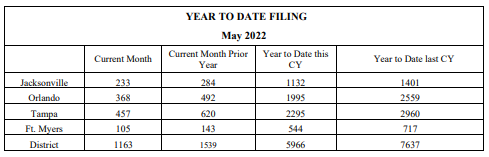

Tampa Chapter 7 Bankruptcy Law Statistics

The United States Bankruptcy Court for the Middle District of Florida is the third busiest bankruptcy court, of the 90 federal districts, in the nation. The statistical data are based upon information gathered from our database.

Frequently Asked Questions for Chapter 7 Bankruptcy

For those who experience all-consuming debts, contacting a Tampa Chapter 7 bankruptcy lawyer, maybe the right way to move forward. Making such a significant financial decision should not be taken lightly, and it’s important for debtors to be as well-informed as possible before moving forward. Before proceeding, Carolyn Secor, P.A. can assist prospective clients with weighing their options and making decisions that are suited for their specific situation. For the appropriate candidate, filing for bankruptcy offers many advantages, including:

- Financial Relief

- A Fresh Start

- Reduces Stress

- Stops Collection Activities

When considering whether to pursue Chapter 7 bankruptcy to eliminate debts, it’s only natural that debtors will have questions regarding the process and the impact…

What does pro se mean? Is it more advantageous to represent me rather than contacting a lawyer?

Pro se means that you will be representing yourself in court. While self-representation is undoubtedly an option, depending upon the specifics of your situation, it may be in your best interest to acquire the services of an experienced lawyer. Having a lawyer offers several advantages for debtors, including:

- Work to reduce financial responsibilities

- Help to protect as many of your assets as possible

- A thorough evaluation of your financial situation

- Someone to manage the paperwork required throughout

- A representative who can negotiate with creditors

Can You Keep Your Car?

In Florida, the value of your car may be a determining factor in whether you can keep it after chapter 7 bankruptcy proceedings. Your attorney will be able to advise you of your options if keeping your current vehicle is a necessity.

What is needed when filing for bankruptcy?

As our Chapter 7 bankruptcy lawyer in Tampa, Florida, will share, several forms must be submitted when filing for Chapter 7. The forms needed can vary depending upon the type of bankruptcy you are filing. However, with the assistance of a legal professional, debtors can have confidence in knowing forms are correctly completed and filed within the appropriate timeframes. Additional documentation required includes:

- Tax Returns

- Bank Statements

- Receipts

- Divorce Decree

- Child Support Order

- Vehicle Titles

- Mortgage Information

- Insurance Policies

- +More

What is the automatic stay? Why is it necessary?

When a person files for bankruptcy, they are granted an automatic stay, which means that creditors’ attempts to collect a debt must halt. The automatic stay stops constant calls from creditors and allows the debtor to get their affairs in order while proceeding with bankruptcy. It’s also advantageous because it stops foreclosure, eviction, utility disconnections, and wage garnishment. However, it’s essential to remember that this relief is only temporary.

What is the approximate cost to file for bankruptcy?

Filing and administrative fees are approximately $335. However, filing for Chapter 7 requires parties to engage in credit counseling and debtor education courses which could cost another few hundred dollars. Additionally, when accessing representation from a lawyer, debtors should also expect legal fees. To gain clear insight into the cost of a lawyer, it’s crucial to have a clear conversation upfront about future expenses. Typically the help of a lawyer can far outweigh the cost.

Are Your Tax Returns Garnished In Bankruptcy?

Filing for bankruptcy may cause you to file your taxes differently. The Carolyn Secor, P.A. team can inform you of how chapter 7 bankruptcy can affect your taxes and any returns you may be entitled to receive. If you are due to receive a return before filing, it may be considered part of your assets, but returns you are entitled to after filing should not affect your case. If your tax returns are garnished, filing for bankruptcy might offer relief in some cases.

Are 529 Plans Safe?

If you contribute to a 529 Savings Plan and you are worried that filing for bankruptcy could affect your child’s ability to afford an education, a Tampa chapter 7 bankruptcy lawyer can help you formulate an appropriate plan that minimizes risks. Whether the 529 assets are protected is often dependent on whether you set up the account yourself and when the funds were deposited. Your attorney can counsel you on the guidelines regarding protected assets and available options for your child’s educational fund.

Does Chapter 7 Help If You Lost Money In Multilevel Marketing?

Some recent studies have shown that bankruptcy filings among sole proprietors listing the names of multilevel marketing companies as a DBA or FDBA have increased. Carolyn Secor, P.A. can advise you of your options if your business venture did not work out as planned and you incurred unmanageable debt. Suppose you purchased inventory using a loan or credit card. In that case, it may be classified as any other consumer debt, and the business structure of the organization you joined is not likely to impact your bankruptcy filing. The losses may be able to be deducted from your taxes.

Carolyn Secor, P.A. Bankruptcy Attorney

8270 Woodland Center Blvd. #540 Tampa, FL 33607

Tampa Chapter 7 Bankruptcy Lawyer Google Reviews

“Carolyn Secor and her paralegal, Sam are both professional, very kind and respectful of your personal situation. Together, they help along in the process and get it done very well! I am thankful that I was introduced to Carolyn and her practice.” – Lisa P.

Call for the Legal Help You Deserve

Filing for bankruptcy is not an impulsive decision that debtors should take lightly. Chapter 7 is a significant financial mood that should be made after assessing your specific financial situation. Additionally, reaching this determination will call on the legal services of Carolyn Secor, P.A. By scheduling a consultation with us, you aren’t obligated to file for bankruptcy; you simply have the opportunity to review whether this is the right next step for your future. Contact our firm to meet with our experienced Tampa, Florida Chapter 7 bankruptcy lawyer to learn more.

For more information about the services provided by Carolyn Secor, P.A., a Tampa Chapter 7 bankruptcy lawyer, schedule a consultation today.